An investment into psychedelic stocks is a high risk, high reward proposition. Psychedelics ETFs, of which four currently exist, aim to lessen the risk involved.

The basic thesis for a psychedelic stock investment is as follows. Across the world, mental health conditions are deteriorating and current treatments are ineffective for far too many people. At the same time, scientific study into psychedelic medicines is showing great promise in treating a range of conditions. As these medicines make it out of clinical trials and become wide-spread treatments, they’ll disrupt the traditional mental health pharmaceuticals market, worth tens of billions of dollars. In five to ten years, if psychedelic medicines have succeeded in gaining wide-spread use, an investment into them now will seem obvious in retrospect.

- To learn the full thesis, read The Thesis for Investing in Psychedelic Stocks.

Despite the above rosy assessment, many risks are also inherent in a psychedelic stock investment. Primary among them, the current levels of competition. As of June 2022, there are more than 50 publicly traded psychedelics companies, and many more private ones. Many, if not most, of these companies will likely ultimately fail. Therefore, in order to reap the massive potential gains of a psychedelic investment, retail investors need to correctly pick which companies will reap the rewards of this transition. And while there are definitely front-runners in this race, lots can change in the upcoming five to ten years.

- To learn more, read Understanding 3 Risks of Investing in Psychedelic Stocks.

Therefore, the base thesis of investing in a psychedelics ETF is to spread your risk among the dozens of companies that professional investors see as those with a realistic shot. This way, the huge potential gains of the few winners will more than make up for the losses of the many losers. To be clear, the potential gains in this scenario would be less than if you had just chosen the winners, but unless you have stolen a wizard’s crystal ball, the likelihood of this is most likely quite low.

Despite an overarching shared thesis, the four psychedelics ETFs differ in philosophy, strategy, execution, and size. This leads them to having different sized stakes in specific companies, and their long-term success will vary.

In this article, I will briefly introduce you to the four psychedelics ETFs, explain their philosophies, and the companies they are currently invested in.

The Advisor Shares Psychedelics ETF: PSIL

Of the four ETFs, the The Advisor Shares Psychedelics ETF (NYSE: PSIL) is the only which is actively managed. This means that Advisor Shares has dedicated researchers and stock analysts deciding which companies to add to the ETF, and which weightings they will hold within it. This allows them to invest larger sums into smaller companies they believe have greater opportunity, or smaller amounts in larger companies which they believe have less potential. It also allows them to more quickly rebalance their ETF in response to changing variables.

PSIL is a pure-play psychedelic medicines ETF, with every company within it being a psychedelic stock. They have $5.9 million under management, invested into 28 psychedelic stocks. As of writing, the stock sits at $2.71, which is down a whopping 70% since its inception last year. This is to be expected —and will be similar to all of the ETFs we look at today —as during this period psychedelic stocks in general have tumbled from their hype-driven highs.

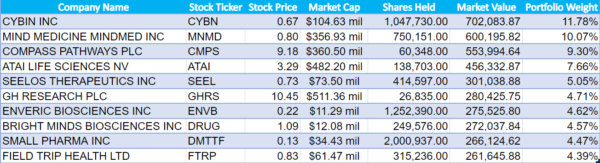

In this chart, you can see the top 10 positions in the PSIL ETF.

As we can see, being actively managed means Advisor Shares can choose the weightings of their investments based on their own expectations of future growth, rather than based on current market cap. For example, they have invested more money into Cybin (NYSE: CYBN) than they have into larger companies such as GH Research (Nasdaq: GHRS) and atai Life Sciences (Nasdaq: ATAI). Obviously, they expect Cybin to have larger returns.

Furthermore, Advisor Shares also has in their top ten investments small companies such as Enveric Biosciences (Nasdaq: ENVB) and Bright Minds Bio (Nasdaq: DRUG) which are tiny compared to the others, with market caps of only $11 million and $12 million respectively. While personally I have no opinion on these companies, as they are currently small, if they do end up being leaders in the field their gains could be astronomical.

Horizon’s Psychedelic Stock Index ETF: PSYK (On the Canadian NEO Exchange)

Like the Advisor Shares ETF, the Horizon’s Psychedelic Stock Index ETF (NEO: PSYK) is a pure-play psychedelics ETF, with all companies held within it being psychedelic stocks.

However, unlike PSIL, the Horizon’s Psychedelic Stock Index ETF is passively managed. This means that the makeup and weighting of the ETF automatically matches some preset index, in this case the North American Psychedelics Index. The goal of this index and ETF is to strictly track the psychedelics market in North America, weighted based on market cap.

This means that the largest companies should be weighted the heaviest in the portfolio, while only holding small amounts of the comparatively tiny ones. The argument for this is that trying to predict which companies will do the best in the future is a fool’s errand, and the most likely predictor of future success is who is doing the best now.

There are a couple of limitations on the fund. First, no company can exceed a weighting greater than 10%. This is why the largest seven each make up around 10%, despite having market caps far larger than the rest. Without this limitation, they would make up almost all of the fund. Second, companies that only dedicate a small amount of their capital to psychedelic medicines, such as Johnson and Johnson, can not be weighted more than 5% of the fund. Finally, the ETF is only rebalanced once per quarter. This means that in the interim, depending on price movements, smaller cap companies can surpass larger ones in the weightings. This is only temporary, however, as it will be reset in the quarterly rebalancing.

PSYK has around $21 million (CAD) under management, invested in 20 different psychedelic stocks. Currently the stock price is $2.65, which is down 61% since its inception last year.

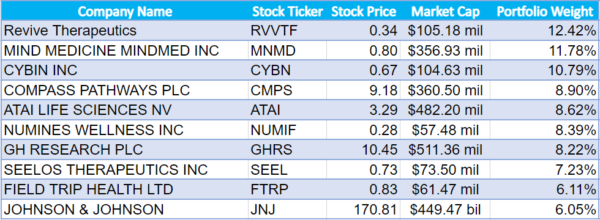

In this chart, you can see the top 10 positions in the Horizons Psychedelics ETF. (Note, Horizons may hold the Canadian version of certain stocks, but for consistency’s sake, we are showing the American tickers.)

As we can see, in the next redistribution, Revive, Mindmed and Cybin will be taken back down to 10%, while Compass, atai and GH Research will be increased to the same amount.

Defiance Next Gen Altered Experience ETF: PSY

Like PSYK, the Defiance Next Gen Altered Experience ETF (NYSE: PSY) is passively managed based on market cap, this time tracking an index called the BITA Medical Psychedelics, Cannabis, and Ketamine Index.

Unlike the previous two ETFs, this index has different inclusion criteria that allow for cannabis companies to be included. Rebalancing twice a year, no company may exceed 7% of the index.

PSY has $7.78 million under management, with a stock price of $4.93. Since its inception last year, it’s down 81%. There are 21 stocks in PSY.

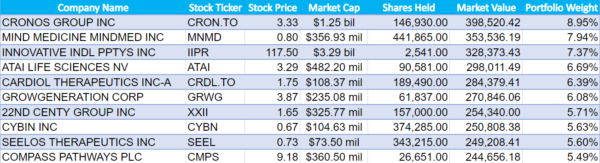

Here are the top 10 holdings of PSY.

As you can see, many of the companies held in the ETF —including Cronos Group, who holds the top position— are cannabis companies. For those who are looking for exposure solely to psychedelic medicines, without cannabis, this ETF is likely not for you.

The Elemental Advisors PSYK ETF: PSYK (on the NYSE)

The Elemental Advisors run PSYK ETF (NYSE: PSYK), like the previous two, is passively managed based on market cap, this time tracking the Enhanced Consciousness Index. However, unlike the other two, the underlying index uses a “proprietary natural language processing algorithm” to pick eligible companies. This algorithm aims to “identify companies that have or are expected to have significant exposure to the field of psychedelic treatment.”

Not all the companies included must be primarily focused on psychedelics, however. According to the ETF’s prospectus, “if fewer than 25 psychedelic treatment companies qualify for inclusion in the Index, the Index will also include neurology biopharmaceuticals companies.” This appears to be the case, as many of the larger companies are those working on solving the same problems as the psychedelics industry —such as various forms of depression and central nervous system disorders— but are doing so without psychedelic compounds.

The PSYK ETF is rebalanced once a quarter, though companies can only be added to or dropped from the index once a year.

In comparison to the above three ETFs, PSYK is tiny, with only $706,561 under management. The stock price is currently $17.14, which is down 19% from its inception almost 4 months ago.

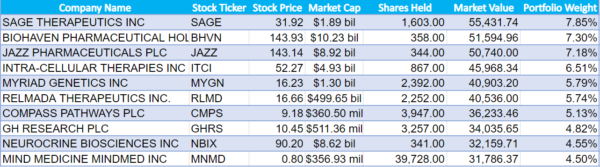

Here are the top 10 holdings of PSYK.

Interestingly, of the 26 companies found within the fund, many are not well known in the psychedelic investment community. Take for example the top position, Sage Therapeutics.

Sage is a company that is working on neurobiological solutions to brain health disorders. They do not appear to be linked too closely to the psychedelics industry, though they are attempting to treat similar conditions, such as different forms of depression.

If, as an investor, your main goal is to invest in solutions to mental health issues, regardless of how the companies get there, then the PSYK ETF is an interesting prospect.

Final Thoughts

Investors looking to dip their toes into the psychedelics revolution, but who want to spread their risk, have a wealth of options when it comes to ETFs. Depending on your preferences, you can have an actively managed portfolio with the Advisor Shares PSIL, or a passively managed one with Horizon’s PSYK, Defiance’s PSY or Elemental’s PSYK.

You can choose from pure-play psychedelics ETFs with either PSIL or Horizon’s PSYK. Likewise, you could choose a psychedelics ETF which also includes cannabis health companies with PSY, or one which includes exposure to other neurology biopharmaceuticals companies, with Elemental’s PSYK.

Regardless of which you choose, remember that even ETFs can carry significant risk, and that the psychedelic medicines industry is still highly speculative and there is no guarantee of success. While I can not give financial advice, I would suggest that if you are making an investment into the industry, it be as a small proportion of your overall portfolio. While I personally believe time will vindicate psychedelics stocks, and the epic crash of the last year will be reversed in the next five years, I could be wrong.

Echoing the call for prudence, PSYC Corp’s Chief Financial Officer, Craig Schlesinger, says that “patience always pays off in market conditions we’re currently experiencing. Trying to catch a falling dagger isn’t necessarily the best strategy. Psychedelics ETFs are yet to form a concrete bottom and are, in fact, retesting their respective 2022 lows. While I’m favorable on the long term risk-reward scenario of the sector, investors need to approach psychedelics ETFs with caution, as bottoms are only confirmed in hindsight.”

____________________________________________________________________________

Interested in Investing in More than Just Psychedelic Stocks?

Do you want to start investing but need help researching stocks? Check out Wealth Research Group’s FREE stock report: Ultimate Forever Stocks: Hold and Add More for the Remainder of Your Life!

This FREE stock report dives into EIGHT stocks that our partners Wealth Research Group believe will transform your portfolio.

Completely FREE, Wealth Research Group won’t spam you and will NEVER ask for your credit card. So what do you have to lose? Plus, by downloading the report, you SUPPORT PSYCHEDELIC SPOTLIGHT, so it is a win-win!

Click here to download Ultimate Forever Stocks